Should I buy a house or continue renting?

Deciding whether to buy a house or continue renting is a significant decision that depends on various factors. Here are some key considerations to help you make an informed choice:

Benefits of Buying a House

- Building Equity: When you buy a home, your mortgage payments contribute to building equity in the property, which can be a valuable financial asset over time.

- Stability: Owning a home provides long-term stability. You won’t have to worry about rent increases or lease terminations, giving you a sense of permanence.

- Personalization: As a homeowner, you have the freedom to renovate and personalize your home to suit your tastes and needs without needing landlord approval.

- Potential Appreciation: Real estate can appreciate over time, potentially increasing your investment’s value. While markets fluctuate, many homeowners benefit from long-term property value appreciation.

- Tax Benefits: Homeowners may be eligible for tax deductions on mortgage interest and property taxes, which can provide financial benefits.

Benefits of Renting

- Flexibility: Renting offers flexibility, allowing you to move more easily for job opportunities, lifestyle changes, or personal preferences without the burden of selling a property.

- Lower Upfront Costs: Renting typically requires lower upfront costs compared to buying a home, which usually involves a down payment, closing costs, and moving expenses.

- Maintenance-Free Living: As a renter, you are not responsible for maintenance and repair costs. The landlord handles property upkeep, which can save you time and money.

- Market Risks: Renters are not exposed to the risks of real estate market fluctuations. You won’t lose money if property values decline, which can be a concern for homeowners.

- No Property Taxes: Renters do not pay property taxes, which can be a significant financial responsibility for homeowners.

Key Considerations

- Financial Situation: Assess your financial stability, including your savings, credit score, and income. Ensure you have enough for a down payment, closing costs, and an emergency fund.

- Long-Term Plans: Consider your long-term plans and how long you intend to stay in one place. Buying is typically more advantageous if you plan to stay in the home for several years.

- Local Market Conditions: Research the real estate market in your area. Compare rental prices to mortgage payments and consider the potential for property value appreciation.

- Lifestyle Preferences: Think about your lifestyle and preferences. If you value flexibility and mobility, renting may be more suitable. If you desire stability and a place to call your own, buying might be the better choice.

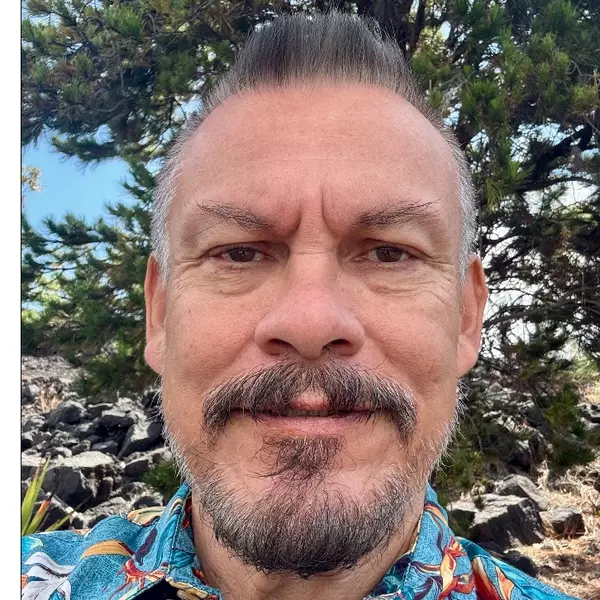

Ultimately, the decision to buy a house or continue renting depends on your personal circumstances, financial situation, and long-term goals. Carefully weigh the pros and cons of each option to make the best choice for your future. If you need personalized advice, feel free to contact me, and I’ll help guide you through the process.

Recent Posts

January Calendar

Box Jellyfish Calendar

6 Causes of Buyer’s Remorse After Buying a House, According to Homeowners

Transform Your Home: Smart Remodeling Tips for a Fresh New Look!

Big Island History

Discover Big Island’s Top Attractions & Must-Visit Places!

Property Spotlights by Andy Madrid

Living the Big Island Dream: Real Insights, Real Perspectives

Should I buy a house or continue renting?

What factors should I consider when buying a house?